Portfolio Links

Model 1 Performance (To know more about it click here)

Model 3 Performance (To know more about it click here)

Nifty Future Long-Short Strategy Performance (To know more about it click here)

Weekly Portfolio Performance Chart

Over the last weekend there was ceasefire between India & Pakistan and on Monday Nifty was up almost 900+ points. The Nifty Index was able to cross 25000 mark after 8 months and managed to close above it. We have seen volatile weekly index expiry on Thursday. The GST collection for April 2025 comes at ₹2.37 lakh crore (up 12.6% YoY), which represent the healthy growth. India April’s CPI inflation dropped to 3.16% from 3.34% In March. RBI has reduced the repo rate by 25bps to 6% in April 2025 policy meet and change the policy stands to accommodative. Globally, The US and China trade talk is going on and both the counties has reduced the tariff on each other. The US GDP contracted for Q1 2025 at -0.3%, which is way below the forecasted number. The US CPI reduced to 2.3% in April compared to 2.4% in March. In the US inflation is coming down and unemployment rate is also increasing a bit. The Fed has maintained the policy rate and forecasted 50 bps cut for 2025 with inflation predication of 2.7%.

Weekly recap:

The Bank Nifty Index has underperformed the Nifty Index and the Nifty IT index has outperformed the Nifty Index this week.

This week, Nifty Midcap 100 Index is up +7.21 percent.

The Nifty Index is up +4.21 percent.

Key Levels for the Nifty Index Daily Timeframe

20 EMA - 24329

50 DMA - 23471

200 DMA - 24054

Nifty Weekly Timeframe Levels

Open - 24420.10

Low - 24378.85

High - 25116.25

Close - 25019.80

Nifty closed above 200 DMA, 50 DMA and 20 EMA suggesting up trend in the Nifty Index.

Model 1 & Model 3

This week, Model 1 is up +3.40 percent and Model 3 is up +6.55 percent.

Model 1 and Model 3 have underperformed the Index by -0.81 percent and -0.66 percent respectively.

Nifty Long-Short

The Long-Short strategy for the Nifty Index has returned a negative result of -4.66 percent this week.

Next Week Update

The Nifty Long-Short Strategy's current position is Long.

Long-term Performance Summary

Monthly Performance Summary of Models

*After brokerage and taxes, returns are determined at the performed deals.

In April 2025, Models 1 and 3 returned +0.3 percent, and +5.4 percent respectively, compared to the Nifty 50 Index's +3.5 percent return.

In April 2025, the Nifty Long-Short is up +17.3 percent.

For the Year 2024 Model 1, 3 and Nifty Long Short returned +25%, +45%, and +76% respectively, compared to the Nifty 50 Index's return of +9%.

For Financial Year 2024-2025 Model 1, 3 and Nifty Long Short returned -2.75%, +10.33% and +147.49% respectively, compared to the Nifty 50 Index's return of +5.34%.

Year To Date - 2025

Models 1 and 3 returned -12.53 percent and -7.66 percent respectively, compared to Nifty's +5.82 percent return for 2025.

The Nifty Long-Short year-to-date return (from January 1, 2025) is now +42.08 percent, compared to the Index's +5.82 percent.

Summary since inception

Since its debut, Model 1 has increased by 247 percent. The Nifty index has risen by 132 percent over the same time span.

Since its debut, the Nifty long-short strategy has increased by 663 percent on the capital and 1228 percent on the margin money.

Model 1 has been operational since July 13, 2020, whereas the Index Long-Short strategy has been operational since August 14, 2020.

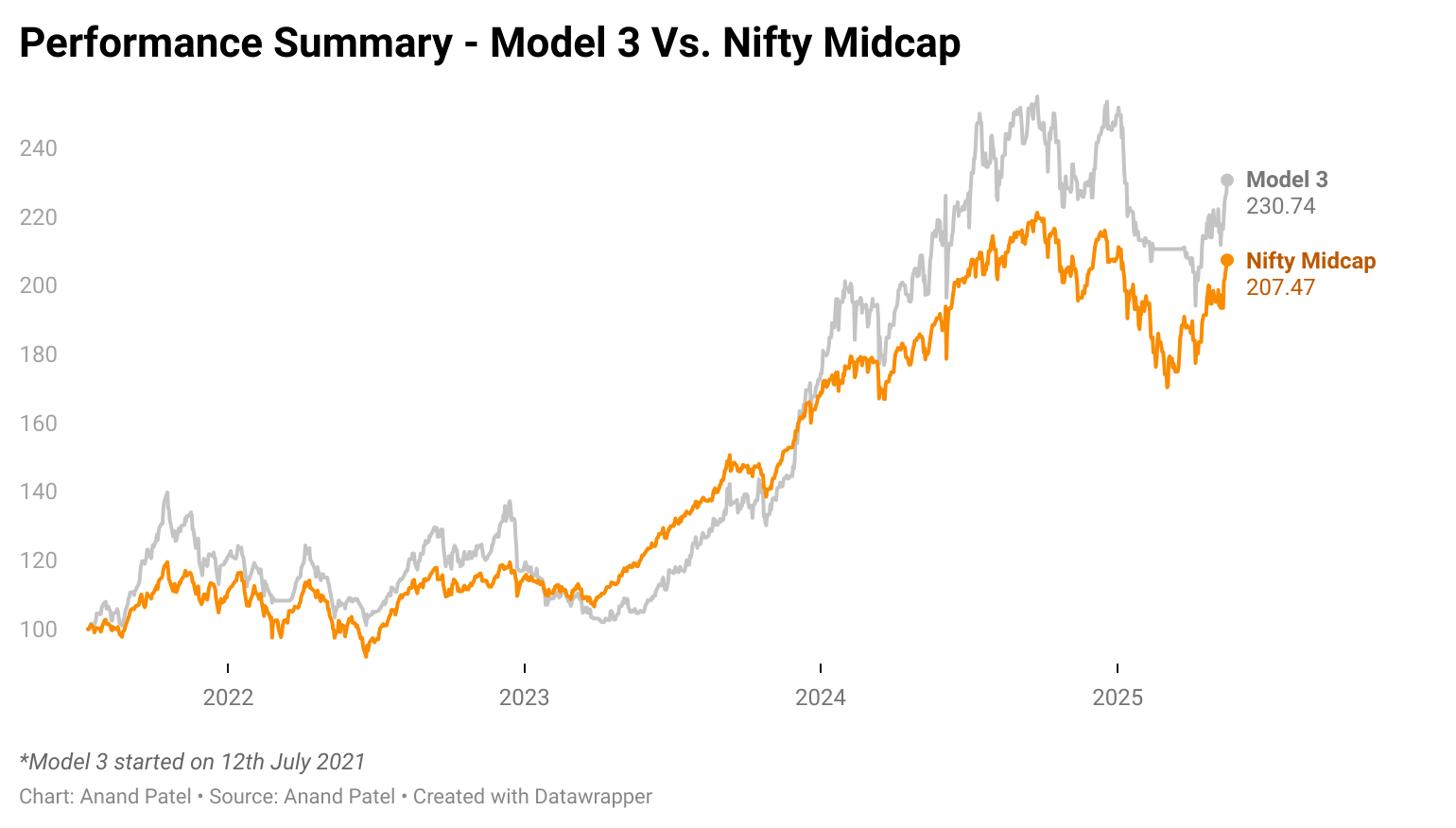

Since the inception, Model 3 is up +131%, compared to 107% for the Nifty Midcap Index.

Model 3 has been operational since July 12th, 2021.

________________________________________________________________________________________________

Looking to invest? You can find our terms of service here. Or you can write to us and we will get back to you