Portfolio Links

Model 1 Performance (To know more about it click here)

Model 3 Performance (To know more about it click here)

Nifty Future Long-Short Strategy Performance (To know more about it click here)

Weekly Portfolio Performance Chart

We saw very poor Q2 GDP growth figures over the last weekend. However, the market does not respond to it negatively. The market appears to have factored in the poor numbers already. The RBI maintained the repo rate at Friday's monetary policy meeting while lowering the CRR by 50 basis points, which will increase bank liquidity by 1.16 lakh crore. The Nifty Index is on an upward trend this week, and it appears that the RBI's easing of liquidity and FII fund flows are giving the Index momentum. India's Q2 GDP growth rate is 5.4%, which is below the expectation compared to Q1 of 6.7%. The CPI inflation rate in India increased massively from 5.49% in September to 6.21% in October mainly due to the higher food price. November 2024 saw 1.82 lakh crore in GST collection, a 8.5% YoY increase. US inflation increased to 2.6% in October compared to 2.4% in September.

Weekly recap:

The Nifty IT Index and the Bank Nifty Index have outperformed the Nifty Index this week.

This week, Nifty Midcap 100 Index is up +4.08 percent.

The Nifty Index is up +2.27 percent.

Key Levels for the Nifty Index

20 EMA - 24252

50 DMA - 24548

200 DMA - 23720

Open - 24140.85

Low - 24008.65

High - 24857.75

Close - 24677.80

Nifty closed above the 20 EMA, 200 DMA and 50 DMA suggesting up trend in the Nifty Index. The Nifty Index has managed to cross 50 DMA and close above it on closing basis.

Model 1 & Model 3

This week, Model 1 is up +3.53 percent and Model 3 is up +7.13 percent.

Model 1 has outperformed the Index by +1.26 percent and Model 3 has outperformed the Index by +3.05 percent respectively.

Nifty Long-Short

The Long-Short strategy for the Nifty Index has returned a positive result of +5.21 percent this week.

Next Week Update

The Nifty Long-Short Strategy's current position is Long.

Long-term Performance Summary

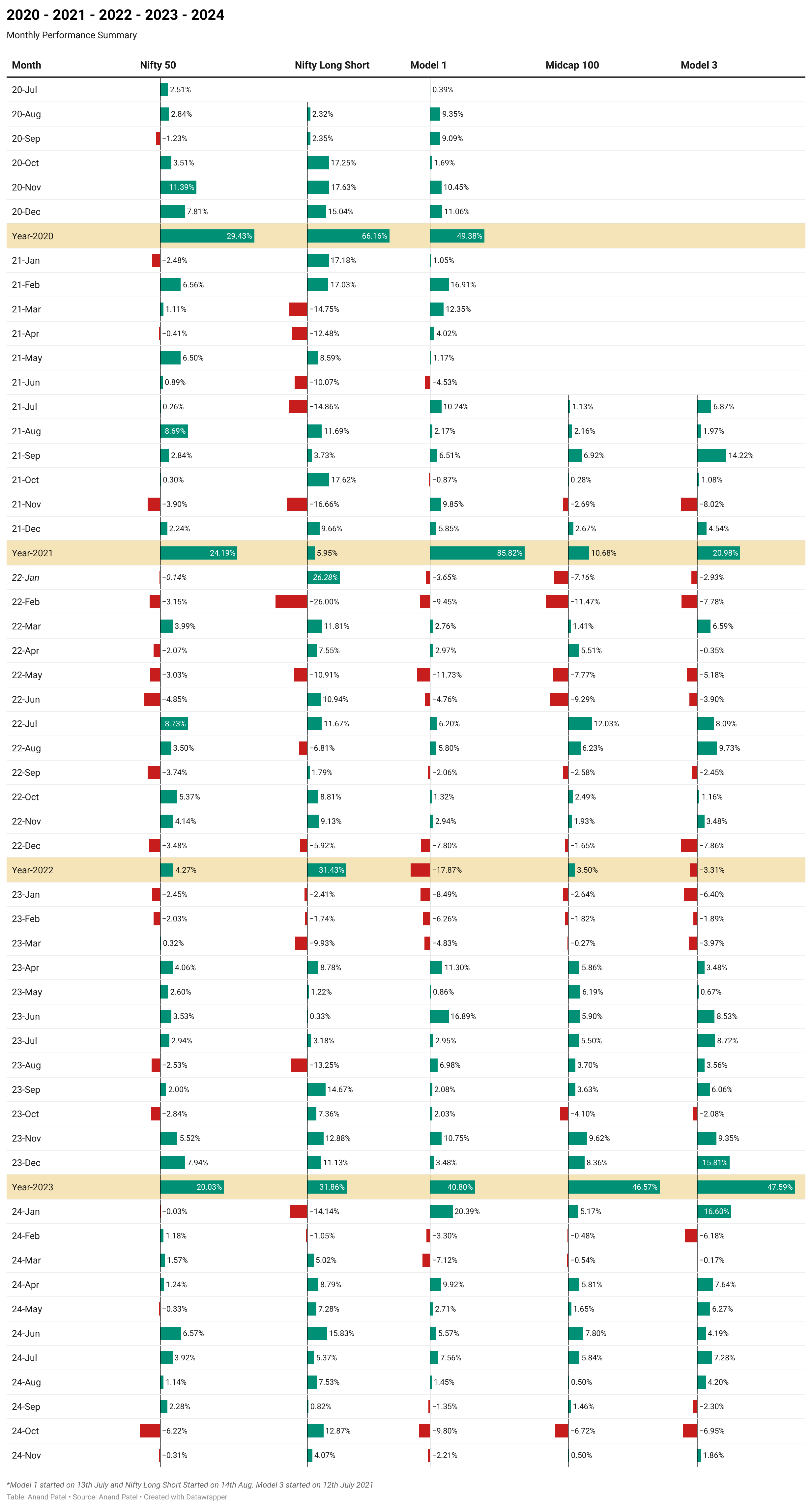

Monthly Performance Summary of Models

*After brokerage and taxes, returns are determined at the performed deals.

In November 2024, Models 1 and 3 returned -2.21 percent, and +1.86 percent respectively, compared to the Nifty 50 Index's -0.31 percent return.

In November 2024, the Nifty Long-Short is up +4.07 percent.

For the Financial year 2023 - 2024 (1st April 2023 - 31st March 2024), Model 1, 3, and Nifty Long-Short returned +86.48%, +82.78%, and +36.20%, respectively, compared to the Nifty 50 Index's return of +28.61%.

Year To Date - 2024

Models 1, and 3 returned +26.65 percent, and +40.02 percent respectively, compared to Nifty's +13.56 percent return for 2024.

The Nifty Long-Short year-to-date return (from January 1, 2024) is now +70.26 percent, compared to the Index's +13.56 percent.

From July 12th, 2021, the Model 3 is up +142%, compared to 113% for the Nifty Midcap Index.

Summary since inception

Since its debut, Model 1 has increased by 302 percent. The Nifty index has risen by 128 percent over the same time span.

Since its debut, the Nifty long-short strategy has increased by 419 percent on capital and 776 percent on margin money.

Model 1 has been operational since July 13, 2020, whereas the Index Long-Short strategy has been operational since August 14, 2020. Model 3 has been operating since July 12, 2021.

________________________________________________________________________________________________

Looking to invest? You can find our terms of service here. Or you can write to us and we will get back to you